![]()

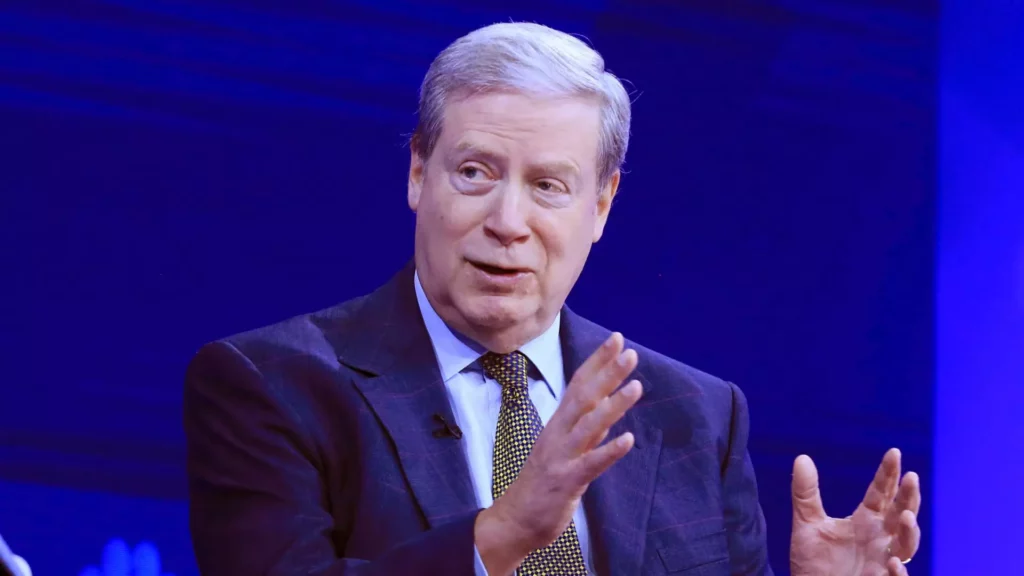

Billionaire investor Stanley Druckenmiller made headlines when he recently revealed that he had significantly reduced his position in chipmaker Nvidia earlier this year. This decision was based on his belief that the rapid growth of artificial intelligence (AI) may have been overdone in the short term, leading to a reevaluation of his investment strategy.

Initial Bet on Nvidia

Initially, Druckenmiller’s interest in Nvidia was sparked by his young partner’s belief that the potential of AI far outweighed the hype surrounding blockchain technology. Despite initially being unfamiliar with the company, Druckenmiller decided to invest in Nvidia, a decision that paid off handsomely as the stock price soared in a short period of time.

However, as the stock continued to skyrocket, Druckenmiller made the decision to reduce his position, citing the sharp increase from $150 to $900 as a cause for concern. Unlike long-term investors like Warren Buffett, Druckenmiller admitted that he prefers to make shorter-term bets and was wary of holding onto the stock for an extended period.

Despite cutting his Nvidia position, Druckenmiller remains optimistic about the long-term potential of AI. He believes that while AI may be overhyped at the moment, its true potential lies in the future, likening it to the early days of the Internet. Druckenmiller envisions a significant payoff in the next four to five years as the technology continues to develop and reshape various industries.

Other Investments

In addition to Nvidia, Druckenmiller had also invested in other tech giants like Microsoft and Alphabet as part of his AI plays over the past year. This diversification reflects his belief in the transformative power of AI and his willingness to capitalize on different opportunities within the sector.

Stanley Druckenmiller’s decision to trim his Nvidia position signals a shift in his investment strategy, driven by his assessment of the current market conditions and his outlook on the future of AI. While he may have taken profits in the short term, Druckenmiller remains committed to the long-term growth potential of AI and will continue to monitor the sector for new opportunities. His experience serves as a reminder of the importance of staying nimble and adaptable in a rapidly changing market environment.

Leave a Reply