![]()

SoftBank has reported a significant gain of 724.3 billion Japanese yen ($4.6 billion) in its Vision Fund during the fiscal year that ended in March. This marks the first time since 2021 that the flagship tech investment arm has been in the black. The Vision Fund segment posted a profit of 128.2 billion yen for the full fiscal year, a notable swing from the 4.3 trillion yen loss recorded in the previous year. This positive result was largely driven by the increase in value of high-profile investments such as ByteDance and DoorDash, though there were still setbacks with investments like DiDi and WeWork.

Impact of Vision Fund IPOs

One of the key contributors to the gain in the Vision Fund was the IPO of chip designer Arm. SoftBank’s consolidated statement of profit or loss does not include gains associated with investments in its subsidiaries, but the success of Arm’s IPO played a significant role in boosting the Vision Fund’s performance. However, when excluding gains linked to investments in its subsidiaries, the tech investment arm actually posted a loss of 167.3 billion yen.

Despite past challenges and losses, there are indications that a recovery is underway for SoftBank. The company showed improved performance in the March quarter, exceeding LSEG estimates for net sales and net profit. While SoftBank still reported an overall loss of 227.6 billion yen for the full year, this figure represented a narrower loss compared to the previous fiscal year’s results. The Vision Fund, which faced significant losses in the prior year, is now showing signs of recovery with the first investment gain in five consecutive quarters.

Shift in Investment Strategy

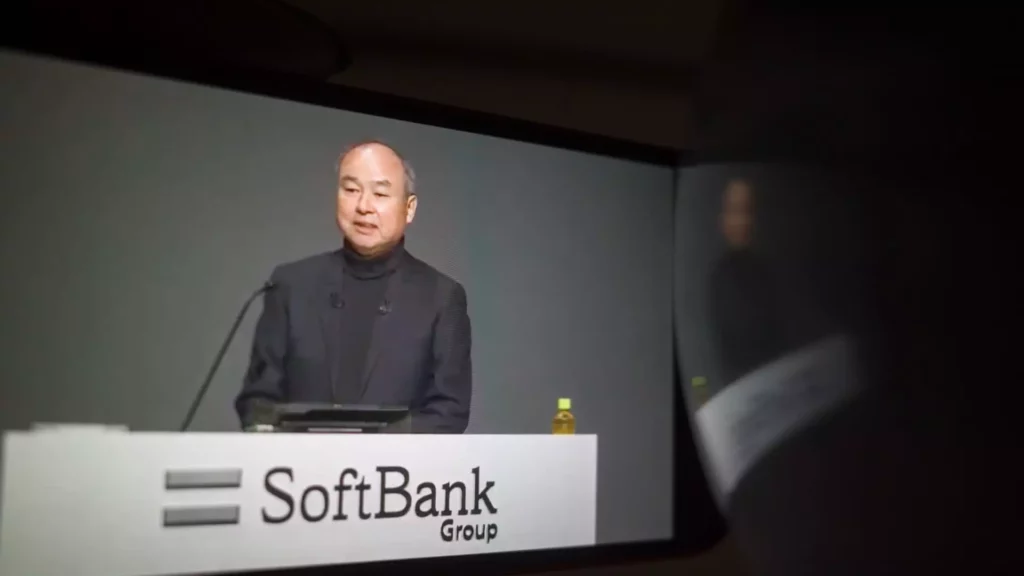

SoftBank founder Masayoshi Son has signaled a shift in the company’s strategy, moving from a defensive posture to an offensive stance. This change in approach signifies a departure from the previous cautious mindset towards making more investments. The company’s Chief Financial Officer, Yoshimitsu Goto, emphasized the transition from an “Alibaba-centric” portfolio to one that is focused on artificial intelligence. With the growing importance of Arm in SoftBank’s portfolio, the company is strategically positioning itself for a future driven by AI technology.

SoftBank’s early investment in Alibaba played a pivotal role in the company’s growth, but now the focus is shifting towards AI and technology investments. As the company reduces its stake in Alibaba, it is increasingly looking towards AI as a key driver of its portfolio. With Arm becoming a central component of its assets, SoftBank is positioning itself to capitalize on the potential of AI technology. Goto’s assertion that “Arm is core to our AI shift” underscores the company’s commitment to leveraging technology for future growth and innovation.

SoftBank’s Vision Fund has experienced a remarkable turnaround, moving from substantial losses to significant gains in the fiscal year. The success of investments such as Arm’s IPO and the performance of key portfolio companies have contributed to this positive outcome. As SoftBank continues to navigate the evolving tech landscape and shift towards AI-centric investments, the company is poised for a future driven by innovation and strategic growth.

Leave a Reply