![]()

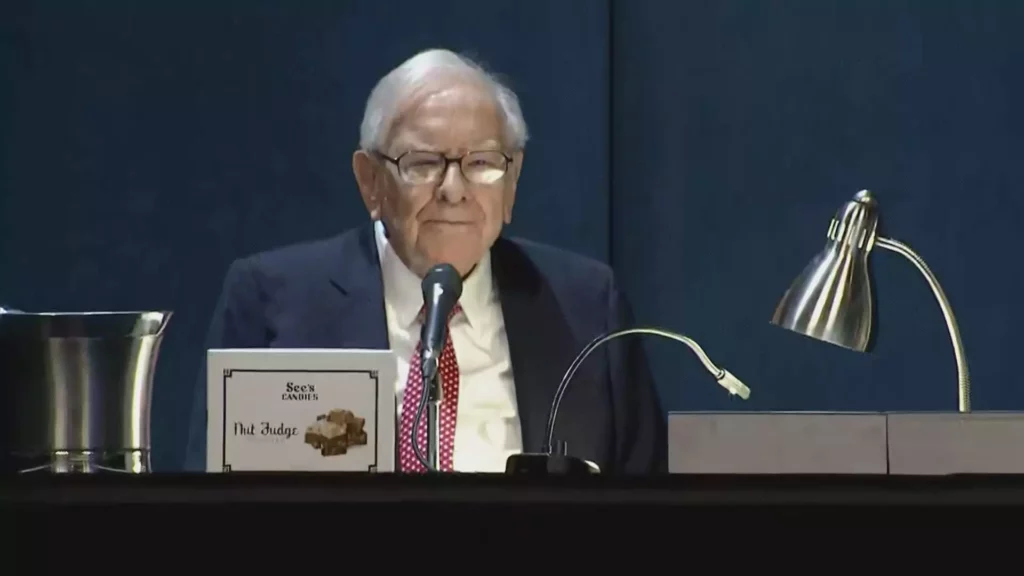

Recently, Warren Buffett made headlines by revealing his secret stock pick in a new regulatory filing – insurer Chubb. Berkshire Hathaway, the conglomerate led by Buffett, has acquired nearly 26 million shares of Chubb, amounting to a stake worth $6.7 billion. This investment has pushed Chubb to become Berkshire’s ninth largest holding by the end of March. Following this news, Chubb’s shares surged by almost 7% in extended trading, and the stock has seen an overall gain of 12% year-to-date.

Berkshire Hathaway, based in Omaha, has a substantial presence in the insurance industry. From the auto insurer Geico to the reinsurance giant General Re, Berkshire has a diverse portfolio of insurance businesses. In addition to Chubb, Berkshire has also acquired insurance company Alleghany for $11.6 billion in 2022. However, the conglomerate recently exited positions in Markel and Globe Life within the same industry.

Interestingly, Berkshire had been keeping its investment in Chubb a secret for two consecutive quarters. The conglomerate was granted confidential treatment to withhold details about one or more of its stock holdings. This mystery holding did not come up during Berkshire’s annual meeting in Omaha, leading to speculation among investors. Many had anticipated that the undisclosed purchase could be related to a bank stock, given Berkshire’s significant increase in “banks, insurance, and finance” equity holdings in recent quarters.

It is relatively uncommon for Berkshire Hathaway to request confidential treatment for its investments. The last instance of such secrecy was observed in 2020 when Berkshire acquired Chevron and Verizon without disclosing details to the public. This strategic move by Buffett and his team highlights their cautious approach to managing investments and maintaining a competitive edge in the market.

Warren Buffett’s revelation of his stake in Chubb sheds light on his investment strategy and the significance of the insurance sector in Berkshire Hathaway’s portfolio. Despite keeping the purchase confidential for several months, Buffett’s decision to disclose the investment reflects his confidence in Chubb’s long-term potential and the value it brings to Berkshire’s expansive business operations.

Leave a Reply