![]()

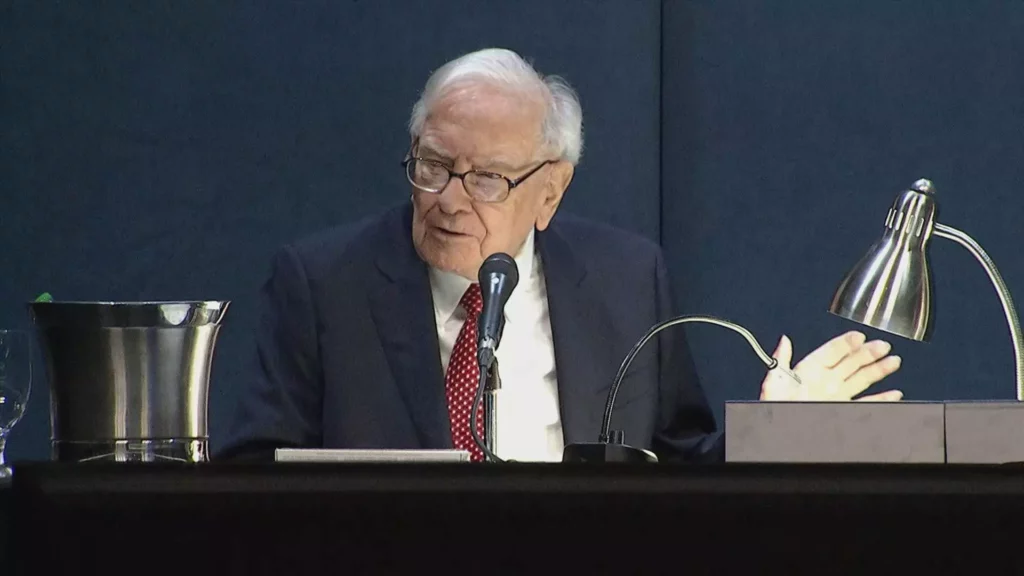

Warren Buffett, also known as the “Oracle of Omaha,” is renowned for his long-term investment strategies. His recent move to have an identical number of shares in both Apple and Coca-Cola has sparked curiosity among investors and analysts. Many are questioning whether this is a mere coincidence or a carefully crafted plan by the legendary investor.

Buffett’s history with Coca-Cola dates back to 1988 when he first bought shares in the company. Over the years, he has steadily increased his stake in the beverage giant, maintaining a round number share count for decades. The recent revelation that he now holds the exact same number of shares in Apple as he does in Coca-Cola has raised eyebrows and led to speculation about his intentions.

Buffett’s investment in Apple, a technology company, seems to contradict his traditional value investing principles. However, he has often compared Apple to a consumer products company like Coca-Cola, emphasizing the loyalty of its customer base and the indispensability of its products. Despite this, Berkshire Hathaway’s decision to sell off a significant portion of its Apple stake in the second quarter came as a surprise to many.

The reduction in Berkshire’s Apple holdings was seen by some as a strategic move related to portfolio management rather than a reflection of Buffett’s confidence in the tech giant. The fact that the remaining stake in Apple now matches the share count of Coca-Cola has led some to believe that Buffett may not be planning to divest any further shares in the iPhone maker. This has added to the speculation surrounding his investment decisions.

While some argue that the alignment of Apple and Coca-Cola share counts is purely coincidental, others believe that Buffett’s meticulous planning and long-term vision may be at play. The comparison between the two companies at Berkshire’s annual meeting, where Buffett highlighted the unlimited holding period for both, suggests a deliberate strategy behind the equalization of share counts.

Warren Buffett’s identical holdings in Apple and Coca-Cola have generated intrigue and debate within the investment community. Whether this is a coincidence or a master plan remains to be seen. However, one thing is certain – Buffett’s investment decisions continue to captivate and inspire investors around the world.

Leave a Reply