![]()

The stock market saw a positive week, with all major averages closing higher. This was primarily driven by softer retail sales and consumer price data for April, which indicated further disinflation. The Federal Reserve cutting interest rates in 2024 is dependent on this disinflation, hence the market reacted positively to the weaker-than-expected reports.

Several economic indicators played a role in shaping the market trends for the week. While U.S. single-family homebuilding and permits fell in April, indicating a slowdown, the producer price index increased by 0.5% for the same month, exceeding expectations. Industrial production, however, came in below expectations. These mixed signals contributed to the market’s uncertainty.

Despite the varied economic indicators, stock performance was generally positive. The S&P 500 closed above 5,300 for the first time ever, signaling investor confidence. The Dow also made history by surpassing 40,000 and closing above that milestone by the end of the week. Both indexes saw gains, with the Dow up 1.2% and the S&P 500 rising by 1.5%. The Nasdaq also climbed by 2.1%.

Within the S&P 500, different sectors showed varying levels of performance. Technology led the upside, followed by real estate and health care. On the other hand, industrials and consumer discretionary sectors closed lower, indicating mixed sector performance during the week.

The second-quarter earnings season is coming to a close, with 93% of S&P 500 companies reporting. The data has been mostly positive, with 78% of companies reporting a positive earnings surprise and 60% delivering a positive sales surprise. This strong earnings performance has contributed to the overall market sentiment.

Looking ahead, the housing market will be in focus as the April existing home sales and new home sales reports are scheduled for release. These reports are crucial as the housing market has been resilient despite higher interest rates, reflecting continued inflationary pressures. Housing costs play a significant role in inflation and impact the Federal Reserve’s decision-making regarding interest rates.

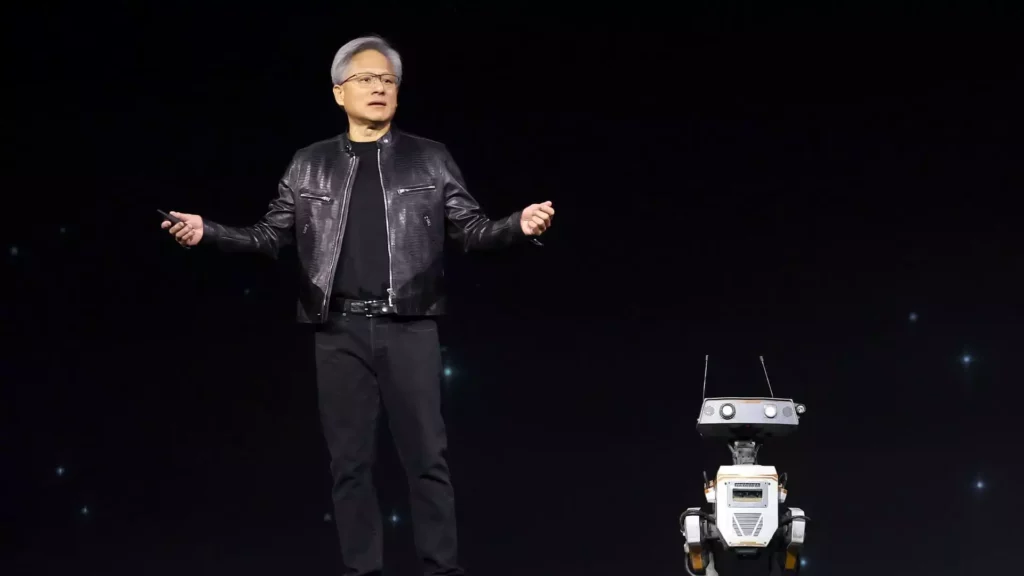

Several portfolio companies are set to report earnings, including Palo Alto Networks, TJX Companies, and Nvidia. Each company has its unique story and growth prospects. Palo Alto Networks aims to bounce back from a challenging quarter, TJX Companies stands to benefit from consumer behavior amid inflation, and Nvidia is expected to deliver strong results driven by demand for its AI chips and software.

The upcoming week will see a flurry of stock reports from companies such as Li Auto, Wix.com, Zoom Video Communications, and many others. These reports will provide further insights into the performance and outlook of various sectors, impacting overall market trends. It is essential for investors to stay informed and analyze the reports to make informed investment decisions.

As a subscriber to the CNBC Investing Club with Jim Cramer, investors receive trade alerts and insights before Jim makes a trade. The club provides valuable information and analysis to guide investors in their decision-making process. However, it is important to note that investing in stocks carries risks, and no specific outcome or profit is guaranteed.

The stock market exhibited positive trends during the week, driven by economic indicators, earnings reports, and sector performance. Investors should closely monitor upcoming reports and stay informed to make well-informed investment decisions. While the market may show signs of resilience, it is essential to approach investing with caution and diligence to navigate the dynamic landscape of the stock market.

Leave a Reply