Finance

-

The Challenge of Achieving the 2% Inflation Goal: An Analysis of Powell’s Remarks

Federal Reserve Chair Jerome Powell recently addressed a policy forum on U.S.-Canada economic relations, highlighting the strength of the U.S. economy. He pointed out that there has been solid growth and continued strength in the labor market. However, Powell also acknowledged that the economy has not seen inflation return to the central bank’s goal of…

-

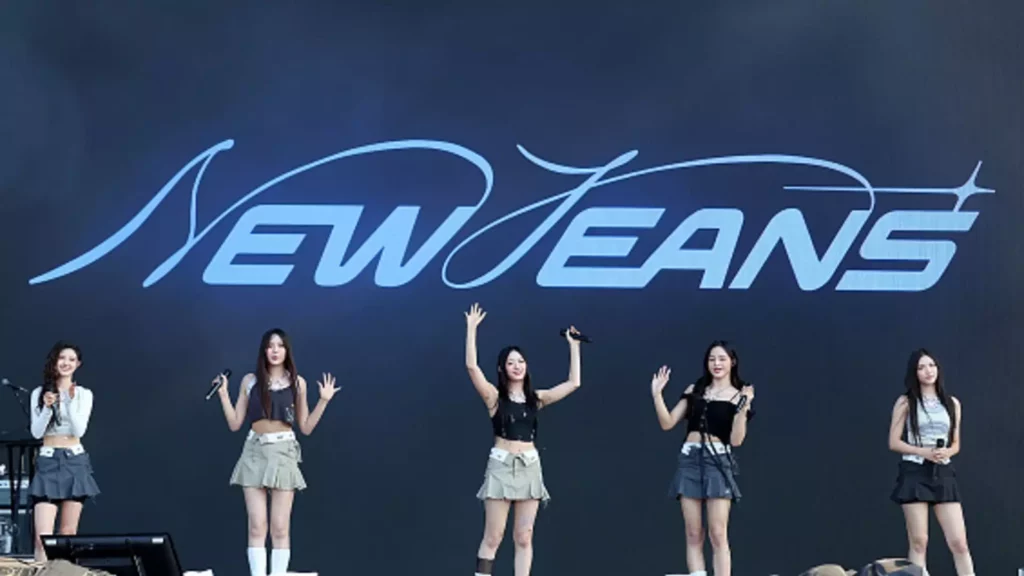

K-pop Sector Faces Challenges Amidst Optimism for Growth

Investors in the K-pop sector have had a rough start to the year, with stock prices of major companies experiencing significant declines. JYP Entertainment, YG Entertainment, Hybe, and SM Entertainment all saw a drop in their stock prices, with some companies experiencing losses of over 30% year to date. The decline was exacerbated by a…

-

Celebrating Freetrade’s Move into Profitability

In a significant turn of events, British stock trading app Freetrade achieved breakeven earlier this year. This milestone marks the company’s first foray into profitability after facing losses in the previous year. Freetrade reported adjusted earnings before interest, tax, depreciation, and amortization (EBITDA) of £100,000 in the first quarter of 2024, according to unaudited financial…

-

The Evolving Landscape of Investment Strategies

Larry Swedroe, a highly respected researcher in the financial market, has brought into question the effectiveness of Warren Buffett’s investment style in today’s market environment. While Buffett was once hailed as the greatest stock picker of all time, Swedroe argues that academic research has revealed otherwise. According to Swedroe, Buffett’s success was not in stock…

-

The Rise of Advance Payments for Electric Vehicle Tax Credits

Recent data from the Treasury Department reveals a significant shift in how Americans are choosing to receive their tax credits when purchasing qualifying new electric vehicles. Instead of waiting until tax season to claim a tax credit worth up to $7,500, about 90% of consumers are opting for advance payments from the car dealer. This…

-

Why Physical Gold Might Be a Better Investment Than Gold Stocks

Investors looking for stability in a volatile market may find that physical gold is a better option compared to gold stocks. This sentiment is echoed by George Milling-Stanley, an expert in the field of gold and the chief gold strategist at State Street Global Advisors. According to Milling-Stanley, owning gold bars provides a layer of…

-

Switzerland’s Banking Regulations May Hinder UBS’s Growth Potential

Switzerland’s recent introduction of stringent banking regulations has raised concerns about UBS’s ability to compete with major Wall Street players. The Swiss government’s 209-page plan, released on Wednesday, outlines 22 measures aimed at increasing oversight of banks considered “too big to fail.” This initiative comes on the heels of the emergency rescue of Credit Suisse…

-

China’s Commercial Property Sector Amidst Real Estate Slump

In the midst of an overall real estate slump in China, certain pockets of demand are emerging within the commercial property sector. One such area experiencing growth is the capital city of Beijing, where rents for prime retail locations are on the rise. According to a report by property consultancy JLL, rents in Beijing increased…

-

A Deep Dive Into Supercore Inflation and Its Implications on Market Trends

In the world of economics, keeping a close eye on inflation is crucial for understanding market trends and making informed decisions. In recent times, the concept of supercore inflation has gained significant attention, especially after it accelerated to a 4.8% pace year-over-year in March, marking the highest level in 11 months. Supercore inflation goes beyond…

-

The Federal Reserve’s Concerns About Inflation

Federal Reserve officials voiced their apprehensions about the sluggish movement of inflation during their March meeting, despite the anticipation of interest rate cuts later in the year. The Federal Open Market Committee maintained the short-term borrowing rates at a steady pace, but expressed doubts about the pace of inflation easing, which was not showing significant…