Investing

-

GameStop and Reddit’s WallStreetBets Reunite: A New Era?

GameStop has once again captured the attention of Reddit’s infamous WallStreetBets community, thanks to the reappearance of the man behind the meme stock phenomenon. The mention of GameStop on the forum has surged in the past week, surpassing even tech giant Nvidia. This resurgence has raised questions about the future of GameStop’s stock and its…

-

Investing with Wall Street’s Top Pros: Recommendations for Your Portfolio

Long-Term Investment Strategies Amidst Uncertainty: Top Stock Picks from Wall Street Experts Navigating the stock market can be challenging, especially during times of macroeconomic uncertainty and unclear Federal Reserve policies. To successfully maneuver through these volatile periods, adopting a long-term investment strategy is crucial. Many investors rely on insights from Wall Street experts who rigorously…

-

Unveiling the Legacy of Charlie Munger Through Art: A Tribute to an Investment Icon

The recent unveiling of a 24-inch tall bronze bust sculpture of the late Charlie Munger sparked conversations among guests staying at the Omaha Marriott during the Berkshire Hathaway annual meeting. Located next to the Berkshire-owned jewelry store Borsheims, the sculpture served as a tribute to the investment icon who passed away in November at the…

-

The Ups and Downs of Zeekr’s IPO Pricing

Chinese electric vehicle maker Zeekr recently priced its initial public offering at $21 a share, marking the top end of its range. The company plans to sell 21 million American depository shares, raising a total of $441 million once it begins trading on the New York Stock Exchange under the ticker ZK. This offering aligns…

-

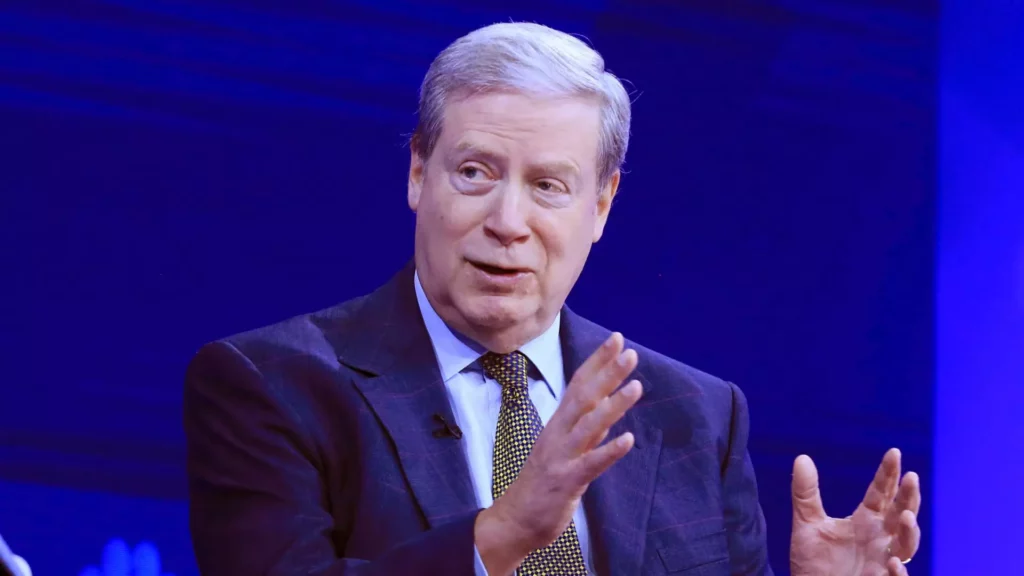

The Rise and Fall of Stanley Druckenmiller’s Bet on Nvidia

Billionaire investor Stanley Druckenmiller made headlines when he recently revealed that he had significantly reduced his position in chipmaker Nvidia earlier this year. This decision was based on his belief that the rapid growth of artificial intelligence (AI) may have been overdone in the short term, leading to a reevaluation of his investment strategy. Initial…

-

Critiquing Wall Street’s Dividend Picks

The first dividend stock highlighted in the original article is Chord Energy (CHRD), an oil and gas operator in the Williston Basin. The analyst from Siebert Williams Shank, Gabriele Sorbara, initiated coverage of CHRD with a buy rating and set a price target of $262. While the analyst emphasized the company’s attractive valuation and capital…

-

The Potential Dangers of Artificial Intelligence According to Warren Buffett

Warren Buffett, the renowned investor, expressed his concerns about the potential harm associated with artificial intelligence during Berkshire Hathaway’s annual shareholder meeting. He emphasized the risks of AI being used for scamming purposes, citing its capability to generate realistic yet misleading content that could deceive individuals into providing money or personal information to bad actors.…

-

The Impact of Warren Buffett’s Berkshire Hathaway Cutting its Apple Stake

In a surprising move, Warren Buffett’s Berkshire Hathaway cut its enormous stake in Apple during the first quarter, signaling a shift in the investment strategy of the legendary investor. As per Berkshire Hathaway’s first-quarter earnings report, the Apple bet was valued at $135.4 billion, which translates to approximately 790 million shares. This represents a decrease…

-

The Impact of Charlie Munger’s Absence on Berkshire Hathaway’s Shareholder Meeting

Warren Buffett will be addressing Berkshire Hathaway’s annual shareholder meeting this year without his longtime partner, Charlie Munger. This absence will undoubtedly impact the tone and atmosphere of the event, which has been dubbed “Woodstock for Capitalists.” The absence of Charlie Munger will result in a more serious and less humorous background at the annual…

-

Microsoft’s $10 Billion Investment in Renewable Energy

In a groundbreaking move, Microsoft has recently announced a partnership with Brookfield Asset Management that will see over $10 billion invested in developing renewable energy capacity. This investment is aimed at powering the growing demand for artificial intelligence and data centers. The deal, which was officially revealed on Wednesday, involves Brookfield delivering 10.5 gigawatts of…