-

Are Activist Investors Losing Their Edge?

In recent years, activist investors have faced defeat after defeat in proxy fights, leading to questions about their credibility and power. These self-proclaimed “activist investors” differ from the original activists who spearheaded necessary governance reforms decades ago. The contribution of today’s activist investors to genuine economic value is debatable, especially considering their track records, which…

-

Housekeepers in High Demand in Palm Beach

The migration of wealthy individuals from high-tax states to Florida has created a booming demand for household staff in exclusive areas such as Palm Beach. Staffing companies are reporting a surge in the need for butlers (now referred to as “hospitality managers” or “estate managers”), nannies, chefs, drivers, and personal security. Despite the high demand…

-

Challenges in the New Home Sales Market

The U.S. Census Bureau reported a 4.7% drop in sales of newly built homes in April compared to March, while also noting a significant 7.7% decrease from the previous year. This decline in sales can be attributed to higher mortgage rates, making it more challenging for potential buyers to afford new homes. The average rate…

-

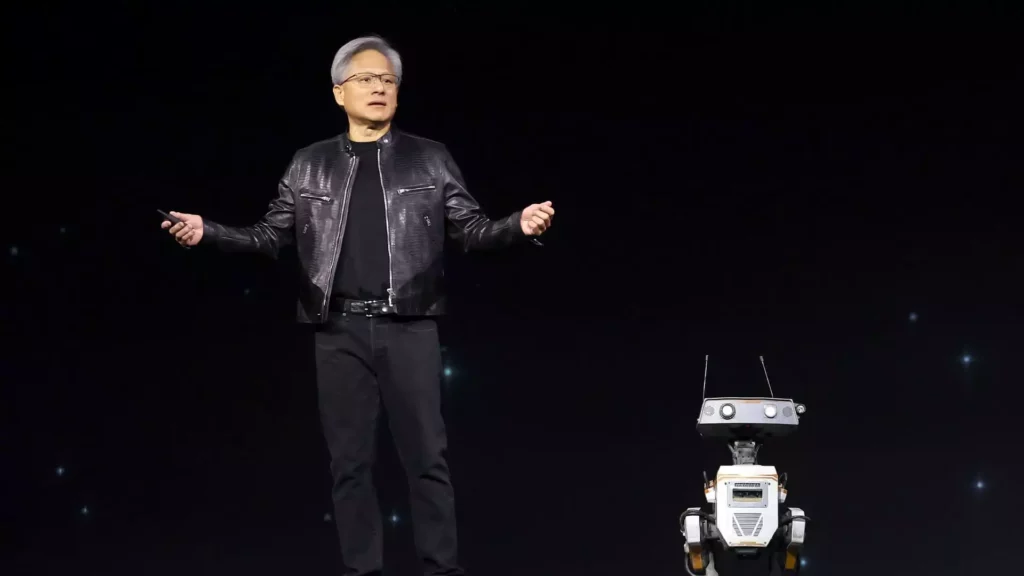

Analysis and Implications of Nvidia’s First Quarter Results

Nvidia recently announced its fiscal first-quarter results, surpassing analyst expectations and leading to a surge in its share price. The company’s stock surpassed $1,000 in extended trading, demonstrating investor confidence in the strength of Nvidia’s performance. The quarterly earnings report not only exceeded estimates but also provided insights into the AI boom and the demand…

-

The Future of the S&P 500 in the Current Market Environment

The S&P 500 reached yet another record close, signaling a 53% surge since the peak of inflation in 2022. Despite concerns of an impending pullback, experts at the CNBC Financial Advisor Summit remain optimistic about the future prospects of the index. Savita Subramanian, head of U.S. equity strategy at Bank of America, expressed confidence in…

-

The Rise and Potential Slowdown of E.l.f. Beauty

E.l.f. Beauty made headlines by achieving its first billion-dollar fiscal year, showcasing an impressive 77% increase in sales. However, despite this significant achievement, the company’s shares experienced a decline due to its forecasted slower growth in the future. Financial Performance During the fourth fiscal quarter, E.l.f. Beauty outperformed Wall Street’s expectations in terms of earnings…

-

The Real Estate Market: A Comprehensive Analysis

The real estate market is constantly evolving, with various factors influencing home sales, prices, and inventory levels. In a recent report by the National Association of Realtors, it was revealed that sales of previously owned homes fell by 1.9% in April from March to 4.14 million units on a seasonally adjusted annualized basis. This unexpected…

-

Analysis of Mortgage Interest Rate Trends

Recent data shows that mortgage interest rates have decreased for the third consecutive week, leading to a surge in demand for refinances. However, while homeowners looking to refinance are taking advantage of lower rates, potential homebuyers do not seem equally enthused. The Mortgage Bankers Association reported a 1.9% increase in total mortgage application volume compared…

-

The Regulation of Buy Now Pay Later Industry Under the Truth in Lending Act

The Consumer Financial Protection Bureau recently declared new rules that will impact the rapidly growing buy now, pay later industry. The agency’s interpretive rule has brought BNPL lenders under the same federal protections as traditional credit card providers, marking a significant shift in the regulatory landscape. This move is aimed at ensuring that consumers are…

-

Impact of Biden Administration’s Student Loan Forgiveness Efforts

The Biden administration recently announced the forgiveness of $7.7 billion in student loans for over 160,000 borrowers. This move is part of the U.S. Department of Education’s efforts to improve income-driven repayment plans and the Public Service Loan Forgiveness program. Education Secretary Miguel Cardona expressed the administration’s commitment to providing relief to millions of Americans…