![]()

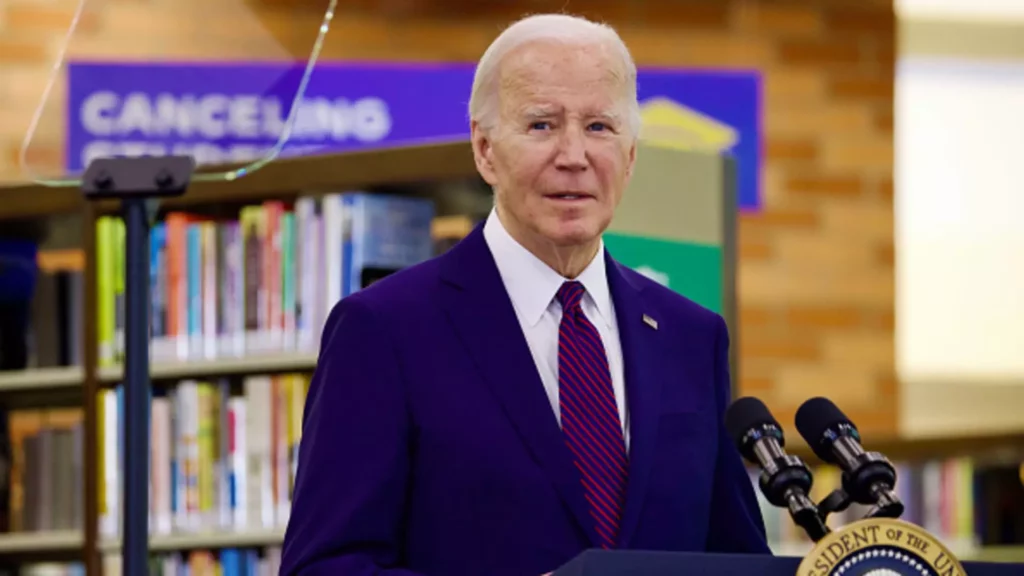

President Joe Biden is set to unveil a new and expanded student loan forgiveness plan that aims to provide relief to tens of millions of Americans burdened by student debt. This announcement comes after the Supreme Court rejected his initial attempt to cancel up to $20,000 in student debt per borrower, deeming it unconstitutional. While the revised plan will be more targeted, it still has the potential to erase or lower balances for many borrowers, pending legal challenges.

The revised plan targets specific categories of borrowers, including those who are already eligible for debt cancellation but haven’t applied, individuals who have been in repayment for 20 years or more on undergraduate loans or over 25 years on graduate loans, attendees of schools with questionable value, and those experiencing financial hardship. The definition of financial hardship is not yet clear, but it may encompass individuals burdened by medical debt or high childcare expenses.

President Biden is also expected to address the cancellation of “runaway interest” for millions of borrowers. Many consumer advocates have criticized the interest rates on federal student loans, which can exceed 8%, leading some borrowers to owe more than they originally borrowed. The new plan aims to forgive up to $20,000 of unpaid interest on federal student debt for all borrowers, regardless of income. Low- and middle-income borrowers could have the entire amount of interest accrued since entering repayment canceled.

The Biden administration believes that its updated plan will withstand legal challenges this time due to its more targeted nature and the use of the Higher Education Act as its legal justification. The President’s initial forgiveness effort was based on the Heroes Act of 2003, which was deemed insufficient by conservative justices. By turning to the Higher Education Act, signed into law in 1965, the administration seeks to leverage the education secretary’s authority to waive or release borrowers’ education debt.

Unlike previous attempts to cancel student debt through executive action, the Biden administration is now using the rulemaking process to deliver relief. This shift in strategy could be driven by a desire to initiate debt forgiveness before the upcoming elections, as canceling student loan debt has emerged as a crucial issue for voters. A recent survey revealed that almost half of voters consider student loan forgiveness important in the 2024 presidential and congressional elections, particularly among younger demographics.

President Biden’s plan is estimated to benefit more than 30 million borrowers, in conjunction with his ongoing debt forgiveness efforts, which have already provided relief to 4 million individuals, totaling $146 billion in aid. By enhancing existing loan relief programs and unveiling a more targeted approach, the administration aims to alleviate the financial strain on millions of Americans grappling with student debt.

President Joe Biden’s new student loan forgiveness plan represents a significant step towards addressing the burden of student debt in the United States. While facing legal challenges, the revised plan offers hope to millions of borrowers by targeting specific categories and providing relief from high interest rates. Through the utilization of the Higher Education Act and the rulemaking process, the administration seeks to deliver tangible assistance to those in need, particularly as student debt cancellation gains momentum as a pressing issue for voters.

Leave a Reply