![]()

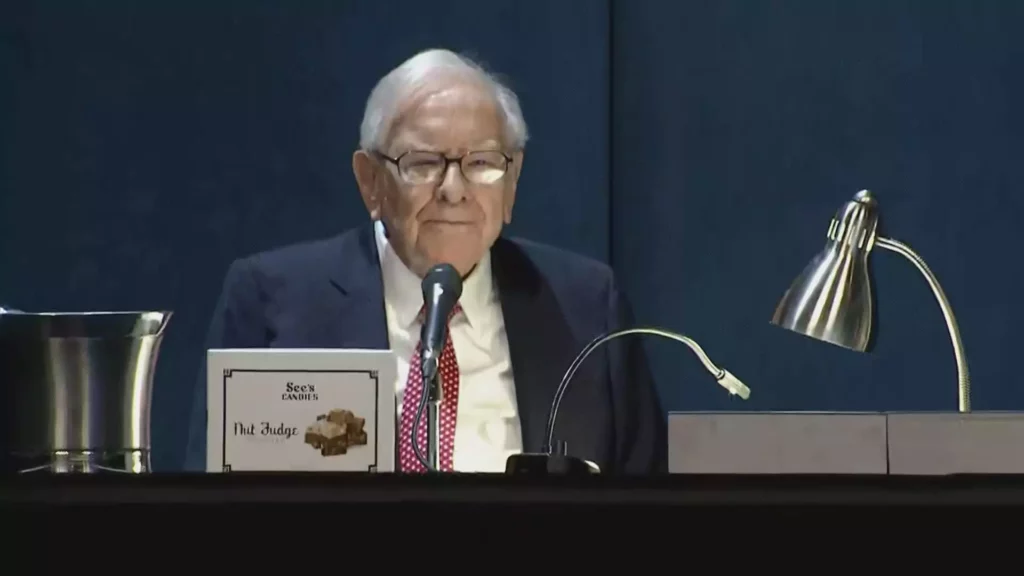

Berkshire Hathaway, under the guidance of Warren Buffett and the late Charlie Munger, has been steadily reducing its massive stake in China’s leading electric vehicle manufacturer, BYD. The conglomerate recently sold an additional 1.3 million shares of BYD on the Hong Kong stock exchange, amounting to $39.8 million. This move decreased Berkshire’s ownership from 7% to 6.9%.

Initially, Berkshire Hathaway entered the scene as an investor in BYD in 2008, when it acquired approximately 225 million shares of the Shenzhen-based company for around $230 million. This investment proved to be highly profitable as the electric vehicle market, both in China and globally, experienced exponential growth. In response to BYD’s meteoric rise, Berkshire began offloading its shares in 2022 and 2023, capitalizing on the stock’s incredible surge of nearly 600%.

Founded by Wang Chuanfu, BYD first made a name for itself in the 1990s by manufacturing batteries for mobile phones. However, by 2003, the company shifted its focus to automobiles and emerged as the top car brand in China. Additionally, BYD established itself as a prominent player in the electric vehicle battery market. In a significant milestone, BYD overtook Tesla as the world’s leading electric vehicle manufacturer in the fourth quarter of 2023.

Warren Buffett credited much of Berkshire’s success with BYD to Charlie Munger, the company’s late vice chairman. Munger’s pivotal role in identifying and advocating for the investment in BYD was crucial to Berkshire’s profitable venture. Munger’s introduction to BYD came through his relationship with Li Lu, the founder of Himalaya Capital, a Seattle-based asset management firm.

Berkshire Hathaway’s journey with BYD reflects the dynamic nature of the investment landscape, characterized by strategic decision-making, market trends, and key individuals’ influence. As Berkshire continues to navigate its investment portfolio, the evolution of its stake in BYD serves as a testament to the ever-changing dynamics of global markets and the importance of informed investment strategies.

Leave a Reply