-

Expanding Home Energy Rebate Programs Across the US

New York Leads the Way in Energy-Efficient Home Upgrades: A Deep Dive into the Inflation Reduction Act’s Rebate Program As part of the federal Inflation Reduction Act (IRA), New York has launched a groundbreaking initiative offering homeowners substantial rebates—up to $14,000—for making energy-efficient upgrades to their properties. This move aligns with the largest climate legislation…

-

The Financial Struggles of Generation X: Navigating Retirement Savings

Navigating the Financial Squeeze: How Generation X is Tackling Retirement Saving As Generation X ages, the pressure of retirement saving becomes increasingly evident, especially for those who find themselves sandwiched between the financial responsibilities of caring for elderly parents and supporting adult children. A report from Natixis Investment Managers revealed that 48% of Gen Xers…

-

The Real Earnings Growth in America: A Critical Analysis

The recent data from the U.S. Bureau of Labor Statistics (BLS) shows a positive trend in the real earnings growth of American workers. From May 2023 to May 2024, the average worker in the private sector experienced a 0.8% increase in their real hourly earnings. This increase indicates that after adjusting for inflation, workers are…

-

The Next Big Money Makers: Generation X

A recent study sheds light on the impending Great Wealth Transfer, a phenomenon where trillions of dollars are expected to change hands from one generation to the next. While it is commonly believed that millennials and Generation Z will be the primary beneficiaries of this transfer, the study reveals that Generation X is actually poised…

-

Unpacking the Challenges of Heirs’ Property and Appraisal Bias in Homeownership

The Complexities of Heirs’ Property and Appraisal Bias in Homeownership Homeownership has traditionally been a cornerstone of wealth accumulation and stability in the United States, often seen as a reliable pathway to building generational wealth. However, recent estimates reveal that over $32 billion in assessed property values across 44 states and Washington, D.C., are jeopardized…

-

Investing in Dividend Stocks: Wall Street’s Top Recommendations

Investors looking for opportunities to stabilize their portfolios during market volatility often turn to dividend-paying stocks. Kimberly-Clark (KMB) stands out as a top dividend pick, according to Wall Street’s best analysts. With popular brands like Huggies and Kleenex under its belt, Kimberly-Clark has established itself as a dividend king, raising dividends for over 50 consecutive…

-

Starboard Value’s Concerns with Autodesk’s Disclosures

Starboard Value, led by Jeff Smith, recently acquired a significant stake in graphics-design firm Autodesk. The activist fund is valued at around $500 million and has expressed serious concerns regarding the company’s disclosures in the aftermath of an internal investigation which led to the removal of its chief financial officer. Starboard’s focus on the technology…

-

The Shophouse Craze in Singapore: What Makes These Colonial-Era Buildings So Attractive to Wealthy Investors?

Singapore, a city known for its modern skyscrapers and bustling financial district, might seem like an unlikely place for wealthy investors to channel their money into century-old colonial-era shophouses. However, these ornate and colorful buildings, steeped in history, have captured the attention of high-net-worth individuals from around the world. Despite the exorbitant costs – with…

-

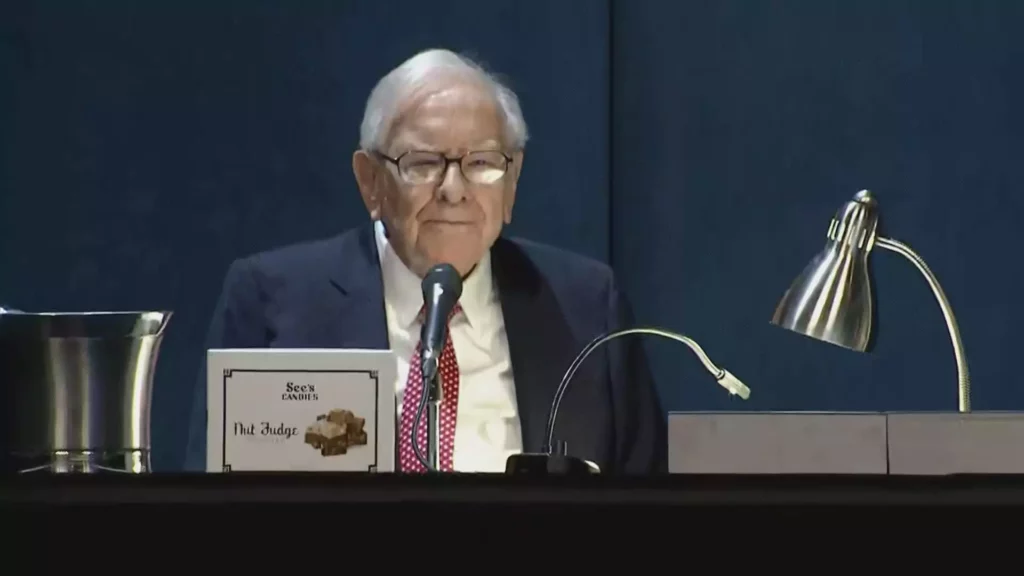

The Evolution of Berkshire Hathaway’s Investment in BYD

Berkshire Hathaway, under the guidance of Warren Buffett and the late Charlie Munger, has been steadily reducing its massive stake in China’s leading electric vehicle manufacturer, BYD. The conglomerate recently sold an additional 1.3 million shares of BYD on the Hong Kong stock exchange, amounting to $39.8 million. This move decreased Berkshire’s ownership from 7%…

-

The Advantages of Early Investing for Gen Z

Gen Z is making a significant impact in the world of investing by beginning their financial journey at a much younger age compared to previous generations. According to the 2024 Schwab Modern Wealth Survey, Gen Z adults typically start investing and saving at the age of 19, which is a distinct advantage over baby boomers…