![]()

The art market is experiencing a noticeable shift as auction houses prepare for their upcoming May sales. It is anticipated that the total sales at auction houses such as Christie’s, Sotheby’s, and Phillips will amount to $1.2 billion, which is an 18% decrease from the previous year. This decline follows a trend that began after the post-Covid peak, characterized by high demand, record sales, and soaring prices. However, the current state of the market indicates a significant downturn, with global fine art auctions dropping by 27% last year, marking the first contraction since the start of the pandemic in 2020. Additionally, the average price of art declined by 32%, representing the largest decrease in seven years.

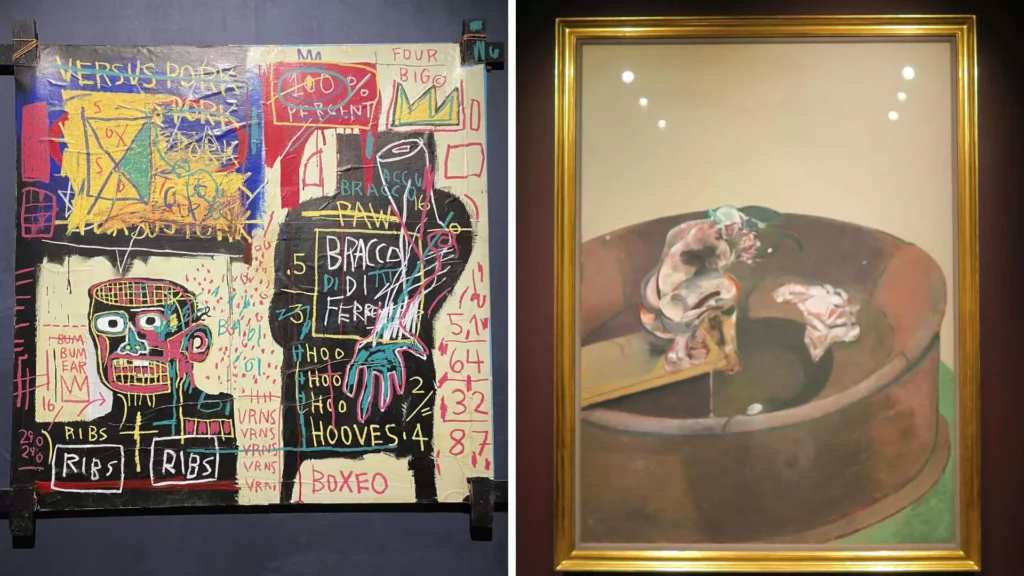

Sales in the contemporary and postwar art categories, which have been major revenue sources for the art market in recent years, plummeted by 48% during the first quarter of this year. This decline can be attributed to various factors, including a lack of high-profile single-owner collections up for sale and a reluctance among collectors to part with their prized artworks in a challenging market environment. The decrease in supply has led to a standoff between buyers and sellers, with sellers expecting higher prices than what buyers are willing to pay, resulting in a stalemate in the market.

Buyers in today’s art market are exhibiting caution and hesitancy due to factors such as inflation, rising interest rates, economic uncertainty, upcoming elections, and geopolitical crises. Collectors, even those with cash on hand, are refraining from making significant art purchases, as the supply of top-tier artworks up for auction remains limited. The lack of confidence among buyers is further compounded by the absence of standout masterpiece works that typically generate enthusiasm and excitement among collectors. Dealers and art advisors have noted a shift in buyer behavior, with many potential buyers opting to wait and observe market conditions before making any substantial investments in art.

Amidst the decline in auction sales, art experts suggest that now may be an opportune time for buyers to seek out bargains and acquisitions at potentially lower prices compared to previous years. Despite the current challenges facing the art market, the long-term outlook remains positive, making it an attractive investment opportunity for those looking to build their art collections. Private sales and galleries have emerged as alternative avenues for art transactions, offering a more stable and less volatile environment compared to public auctions. Notably, the private market has seen robust sales activity, with art advisors highlighting the benefits of targeted approaches and personalized transactions that mitigate risks associated with public auctions.

While the current state of art auction sales reflects a downturn, industry experts remain optimistic about the future of the art market and the opportunities it presents for both buyers and sellers. The evolving dynamics of the art market underscore the need for adaptability and strategic decision-making in navigating market fluctuations and trends. As collectors, dealers, and institutions continue to engage with the art market, there is a collective effort to preserve the value and integrity of artworks while exploring new avenues for growth and sustainability. Despite the challenges faced by the art market, the spirit of creativity, innovation, and appreciation for art endures, shaping the landscape of the industry for years to come.

Leave a Reply